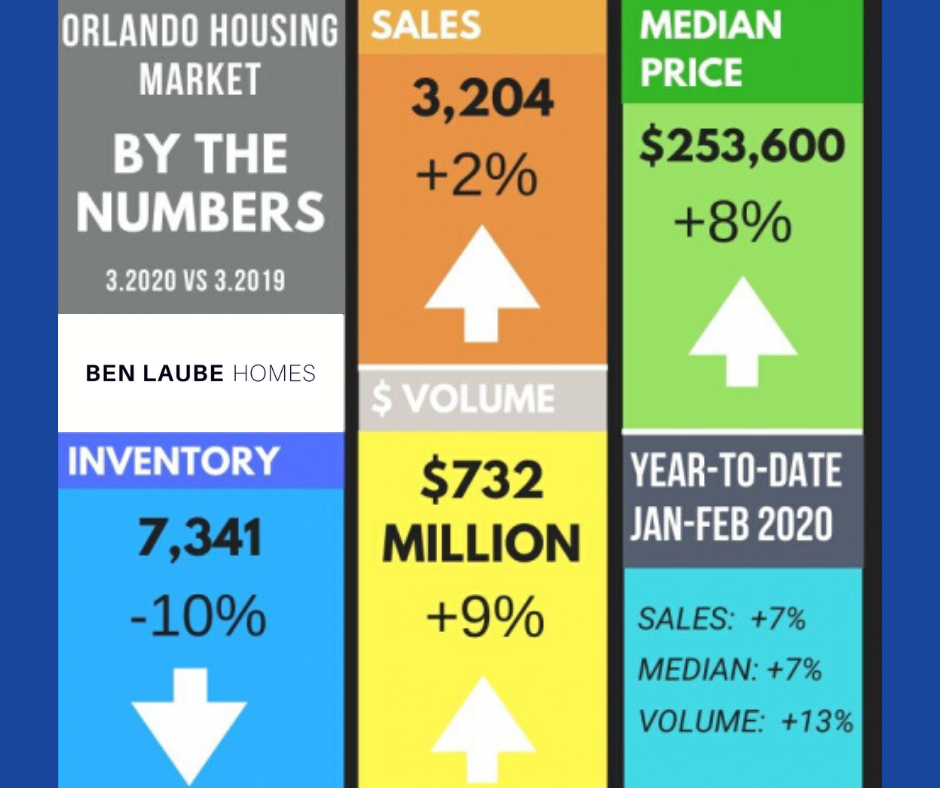

Orlando’s housing market in March saw its home sales improve by nearly 2% compared to March 2019, while the median price increased by 8%. Inventory experienced a year-over-year decline of 10%.

Experts point out that we will have to wait another month to see solid evidence of the influence of the COVID-10 pandemic in Orlando’s home sales statistics. Because of the amount of time it traditionally takes a home to move through the transaction process (an average of 37 days in March), the properties that closed in March most likely went under contract sometime in February, before the stock market declined and stay-at-home orders were in place.

It’s important to remember that we’re in a global pandemic, not a real estate recession. Orlando is a vibrant destination in great demand to new residents, international homebuyers, investors, etc. And it is unclear when we will see a slowdown in sales, all experts can offer is a short-term market prediction. It is likely the long-term strength of Orlando’s real estate market will stay intact.

Median Price

The overall median price of Orlando homes (all types combined) sold in March is $253,500, which is 7.9% above the March 2019 median price of $235,000 and 1.4% above the February 2020 median price of $250,000.

It is likely, the increase in median price can be attributed in part to the historically low interest rates that increase purchasing power and allow buyers to qualify for homes with higher price tags.

The median price for single-family homes that changed hands in March increased 5.9% over March 2019 and is now $270,000. The median price for condos increased 14.5% to $146,000 and townhomes/villas/duplexes increased 5.0% to $220,000.

The Orlando housing affordability index for March is137.63, down from 139.71 last month. (An affordability index of 99% means that buyers earning the state-reported median income are 1% short of the income necessary to purchase a median-priced home. Conversely, an affordability index that is over 100 means that median-income earners make more than is necessary to qualify for a median-priced home.)

The first-time homebuyers affordability index decreased to 97.87 from 99.35% last month.

Sales and Inventory

Members of ORRA participated in 3,204 sales of all home types combined in March, which is 2.0% more than the 3,142 sales in March 2019 and 27.1%

more than the 2,521 sales in February 2020.

Sales of single-family homes (2,544) in March 2020 increased by 3.3% compared to March 2019, while condo sales (352) decreased 11.3% year over year. Duplexes, townhomes, and villas (308 combined) increased 9.2% over March 2019.

Sales of distressed homes (foreclosures and short sales) reached 80 in March and are 27.3% less than the 110 distressed sales in March 2019. Distressed sales made up 2.5% of all Orlando-area transactions last month.

The overall inventory of homes that were available for purchase in March (7,341) represents a decrease of 9.6% when compared to March 2019, and a 7.6% increase compared to last month. There were 14.2% fewer single-family homes; 1.3% fewer condos; and 27.3% more duplexes/townhomes/villas, year over year.

Current inventory combined with the current pace of sales created a 2.3-month supply of homes in Orlando for March. There was a 2.6-month supply in March of last year and a 2.7-month supply last month.

The average interest rate paid by Orlando homebuyers in March was 3.45%, up from 3.43% the month prior.

Homes that closed in March took an average of 54 days to move from listing to pending and an average of 37 days between pending and closing, for an average total of 91 days from listing to closing (down from a total of 94 days the month prior).

Pending sales in March are down 14.9% compared to March of last year and are down 14.7% compared to last month.

MSA Numbers

Sales of existing homes within the entire Orlando MSA (Lake, Orange, Osceola, and Seminole counties) in March were, coincidentally, exactly the same as in March of 2019: 3,612. To date, sales in the MSA are up by 4.1%

Each individual county’s sales comparisons are as follows:

- Lake: 6.7% above March 2019;

- Orange: 1.7% below March 2019;

- Osceola: 1.3% above March 2019;

- Seminole: 2.9% below March 2019.

Source