State of the Market

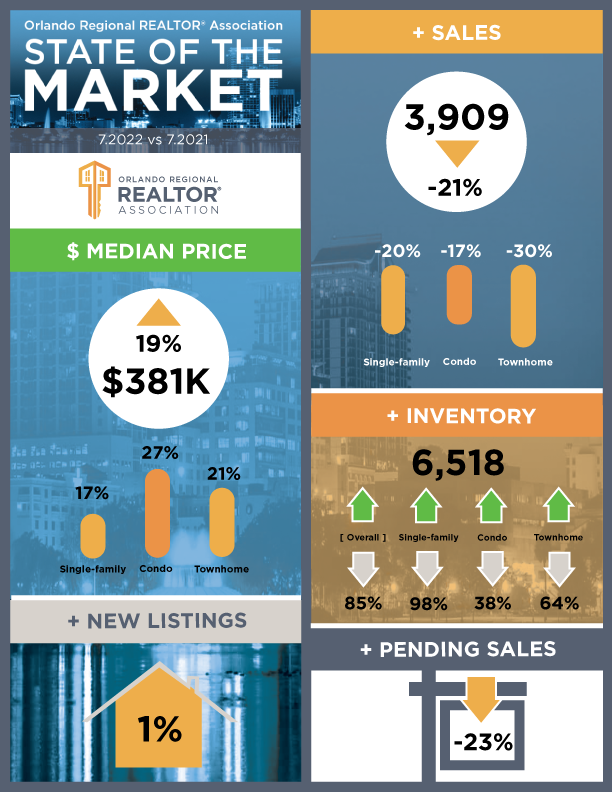

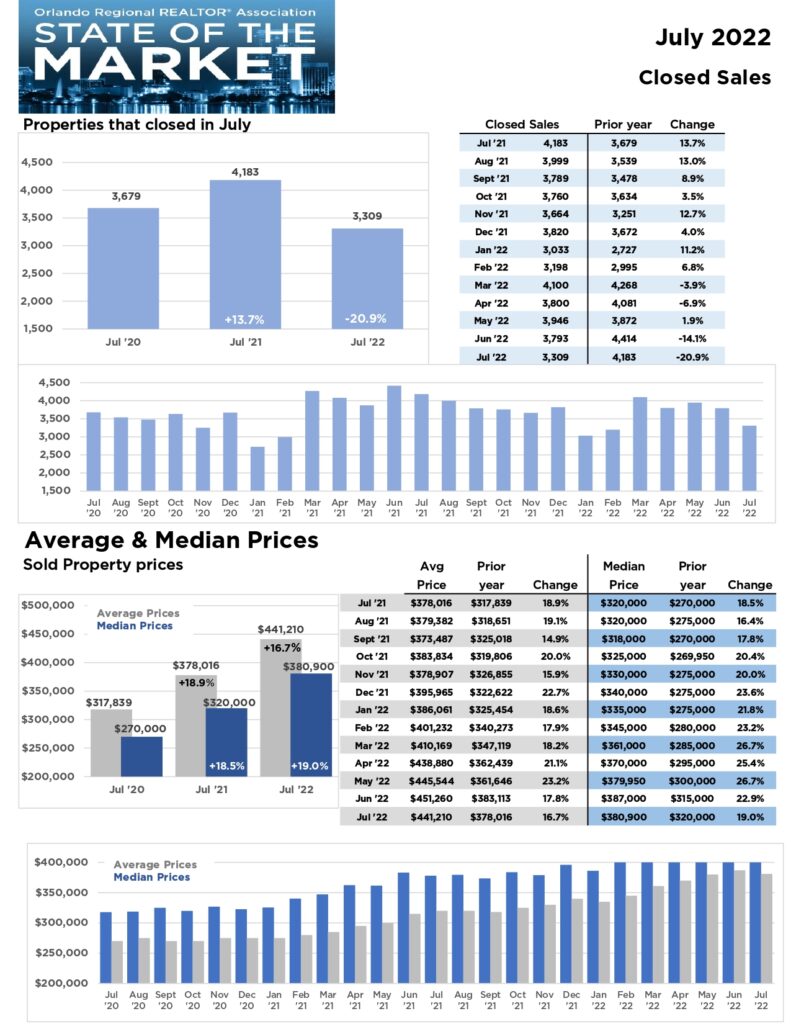

- The median home price for July 2022 was recorded at $380,900, a decrease of 1.6% compared to June. This is the first time in six months that the median home price has fallen.

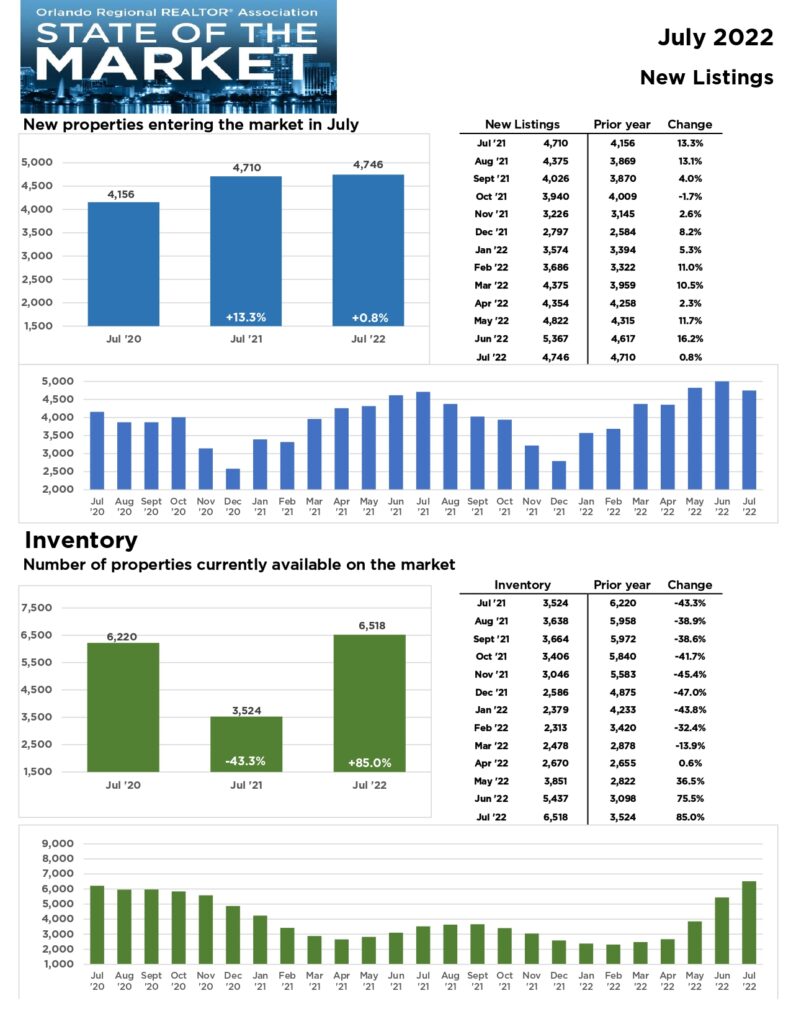

- Inventory jumped by 19.9% in a single month, from June to July – that’s 1,081 more homes for sale. This is the third straight month of double-digit inventory increases.

- Looking at May-July of this year compared to the same period last year, inventory has risen 67.38%. There has been an average of 2,121 more homes on the market this summer compared to last summer.

- Interest rates remained relatively flat – 5% in June vs. 5.4% in July. The July rate is still 89.2% higher than July 2021 when interest rates were 2.8%.

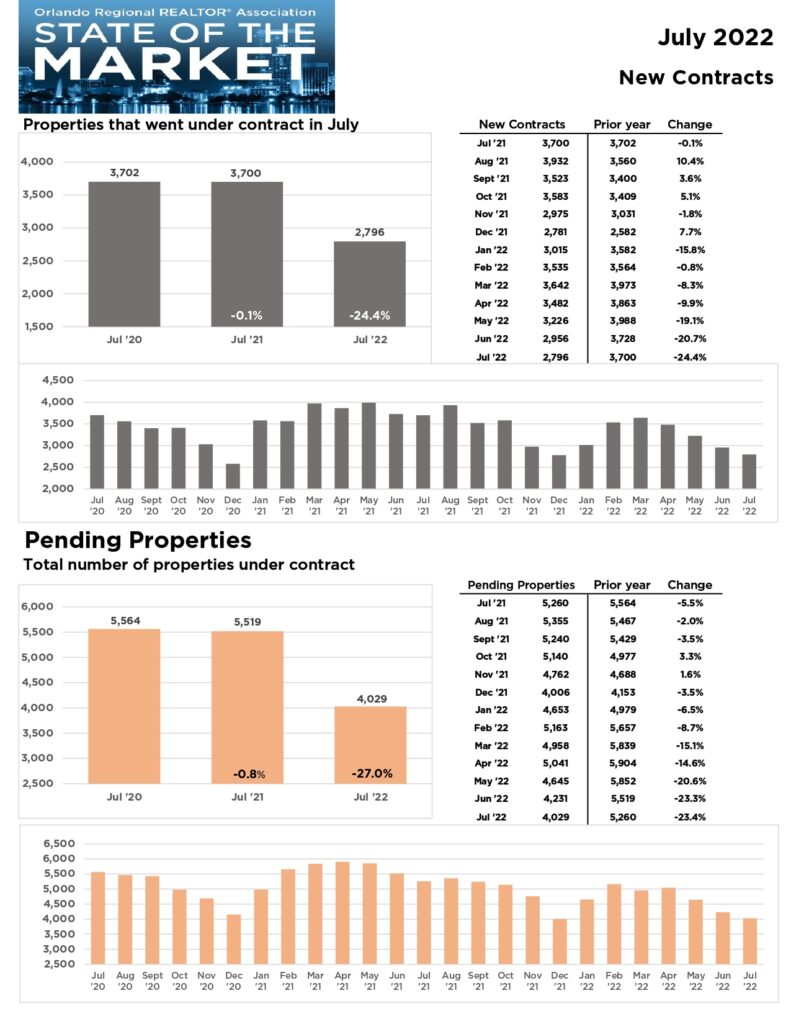

- Overall sales in July 2022 decreased by 12.8%, with a total of 3,309 sales compared to 3,793 sales in June.

- Overall sales dropped 20.9% in July 2022 compared to July of last year.

- Homes spent an average of 21 days on the market in July, up slightly from June when the average was 20 days.

- New listings decreased by 11.6% from June to July, with 4,746 new homes on the market in July.

- “With a drop in median home price and another big jump in inventory, July’s data shows just how quickly Orlando’s housing market conditions can change,” said Tansey Soderstrom, Orlando Regional REALTOR® Association President. “We’ve now seen three consecutive months of significant increases in inventory. While prices may not be dropping much, buyers finally have more options when looking to purchase a home. The local market continues to show signs of cooling off a bit and is trending toward a more balanced market.”

Market Snapshot

- Interest rates fell slightly as the average interest rate for July was recorded at 5.4%. This is 89.2% higher than July 2021 when interest rates were 2.8%.

- Pending sales decreased by 4.8% from June to July for a total of 4,029 pending sales.

- 18 distressed homes (bank-owned properties and short sales) accounted for 0.5% of all home sales in July. That represents a 21.7% decrease from June, when 23 distressed homes sold.

Inventory

- Orlando area inventory increased by 19.9% from June to July from 5,437 homes to 6,518 homes. Inventory in July 2022 was 85% higher than in July 2021, when it was recorded at 3,542 homes.

- The supply of homes increased to 1.97 months in July. This is a 134% increase from July 2021, when there was only supply for .84 months. A balanced market is six months of supply.

- The number of new listings decreased in July from June by 11.6% down to 4,746 homes.

ORRA’s full State of the Market Report for July can be found here.

This representation is based in whole or in part on data supplied by the Orlando Regional REALTOR® Association and the Stellar Multiple Listing Service. Neither the association nor StellarMLS guarantees or is in any way responsible for its accuracy. Data maintained by the association or by StellarMLS does not reflect all real estate activity in the market. Due to late closings, an adjustment is necessary to record those closings posted after our reporting date.

ORRA REALTOR® sales represent sales involving Orlando Regional REALTOR® Association members, who are primarily – but not exclusively – located in Orange and Seminole counties. Note that statistics released each month of be revised in the future as new data is received.

Orlando MSA numbers reflect sales of homes located in Orange, Seminole, Osceola, and Lake counties by members of any REALTOR® association, not just members of ORRA.

Sources: