When Glenn Sanford founded eXp Realty in 2009, one of his main goals was to make the real estate world more equitable for agents and brokers, rather than heavily beneficial for the brokerage.

That’s why he installed a revenue-share plan and an equity plan – so that agents and brokers could also reap the benefits beyond a commission check.

> See why revenue share is better than profit share

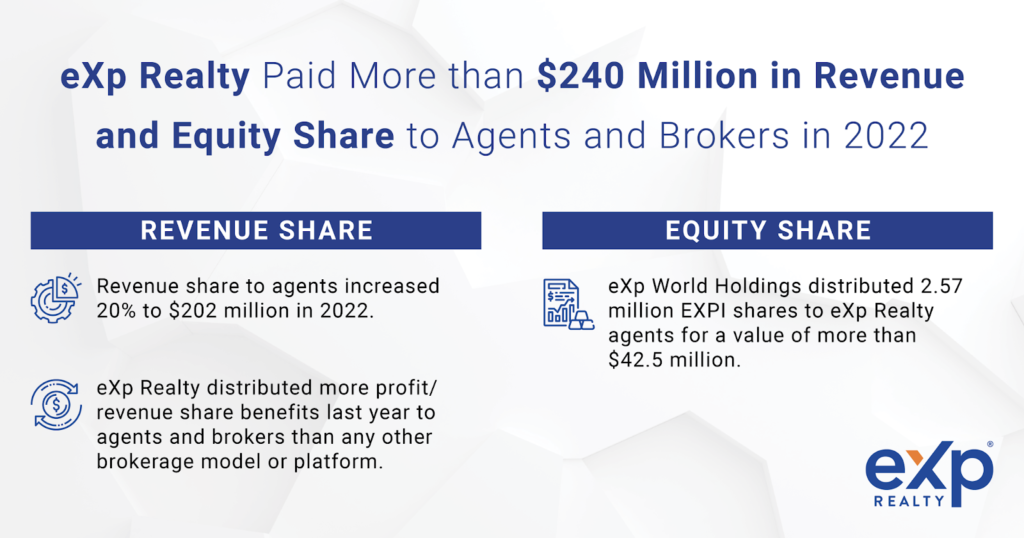

This week, eXp Realty announced its financial and operational results for Q4 and full-year 2022 and as part of that announcement, details on how much revenue share and equity was paid out to its agents and brokers were important line items.

Revenue Share and Equity Paid to Agents and Brokers In 2022:

- Revenue share paid to agents: $202 million, an increase of 20%.

- eXp Realty distributed more profit/revenue share benefits last year to agents and brokers than any other real estate brokerage model or platform.

- eXp World Holdings issued over 2.5 million EXPI shares to eXp Realty agents and brokers valued at more than $42.5 million as part of eXp’s agent equity program.

“When eXp Realty was founded, we set out to build the most agent-centric brokerage that solved the biggest pain point in real estate for agents,” said Glenn Sanford, Founder and CEO of eXp Realty. “Historically, agents were generally not offered meaningful ownership in the brokerages they were part of and the profit/revenue sharing models didn’t provide a viable path to potential retirement for the vast majority of agents.”

> Read Glenn Sanford’s entire quote here.

Safe Harbor Statement

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Such forward-looking statements speak only as of the date hereof, and the company undertakes no obligation to revise or update them. These statements include, but are not limited to, statements about the continued growth of our agent and broker base and expansion of our residential real estate brokerage business into foreign markets. Such statements are not guarantees of future performance. Important factors that may cause actual results to differ materially and adversely from those expressed in forward-looking statements include changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the company’s Securities and Exchange Commission filings, including but not limited to the most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K.

Source: https://life.exprealty.com/revenue-share-equity-programs-payouts-2022/