A land sale has been completed for e-commerce giant Amazon’s latest Central Florida facility.

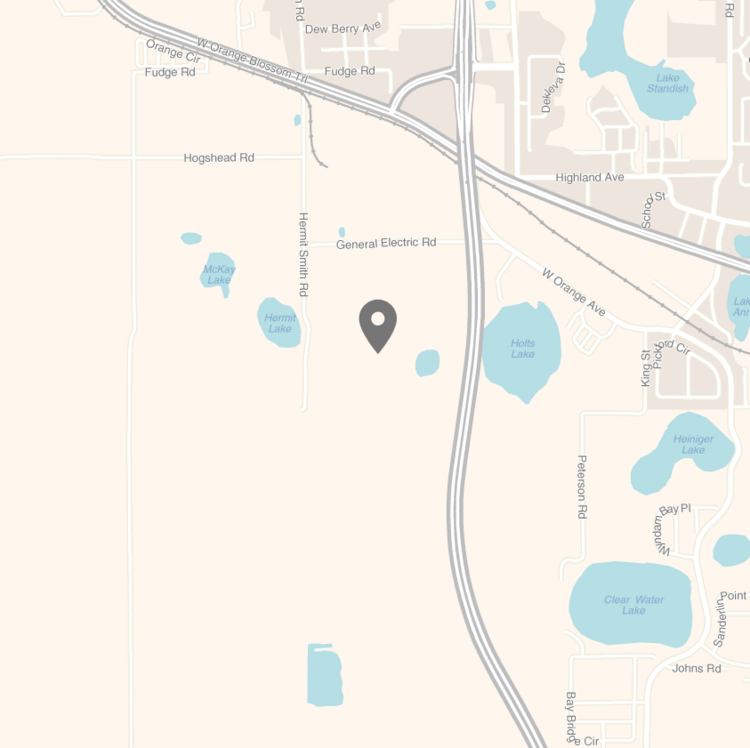

New York-based Nuveen and Atlanta-based Seefried Industrial Properties’ related SIF Apopka Distribution Center LLC on Aug. 5 bought roughly 43.6 vacant acres for $14.4 million, or roughly $330,275 per acre, according to Orange County records and sources familiar with the deal. The seller was BPG Apopka Properties 1 LLC, an entity related to Kansas City, Missouri-based BlueScope Properties Group, developer of the 180-acre, 2.4 million-square-foot Mid-Florida Logistics Park — the complex where the Amazon facility will be built.

Site work already started on Seattle-based Amazon.com Inc.’s future 201,475-square-foot warehouse called “DFL5 Apopka Last Mile.” The project adds to new construction in Central Florida, an important regional economic driver. It creates jobs, while also providing more space for companies involved in e-commerce, logistics, housing and other industries.

Nuveen and Bluescope representatives were unavailable for comment. Owen Torres, a spokesman for Amazon, said the company is “excited to increase our investment in Florida with a new delivery station to provide fast and efficient delivery for customers, and provide hundreds of job opportunities for the talented local workforce.”

In addition, the market’s dynamics are “fantastic,” previously said BlueScope Properties Group President Scott Alexander. “Population growth has driven a lot of things.”

Other companies that have invested in the rising industrial park include Atlanta-based Coca-Cola Co., New Jersey-based Goya Foods Inc. and Universal Orlando Resort.

Industrial explosion

In recent months, developers have been lining up to secure land for projects in the fast-growing Apopka submarket.

In the second quarter alone, the Apopka/Silver Star industrial market featured 656,500 square feet of industrial construction — or a quarter of Central Florida’s total industrial construction, Cushman & Wakefield reported. The submarket also saw 713,916 square feet of industrial space completed in the second quarter. Both of those stats show how bullish investors and companies are on the submarket.

Additionally, some of the latest projects in the works include:

- Orlando-based Cadence Partners LLC is under contract to buy two Apopka sites, which may feature a combined nearly 1 million square feet of space.

- Orlando-based American Land Development of Central Florida LLC wants to build an industrial park on 349.4 vacant acres with up to 4.5 million square feet of space west of Orange Blossom Trail near the intersection with Yothers Road

The projects are timely, as the expansion of State Road 429 and new companies adding jobs have made Apopka a hot spot for housing and other development, said Andy Slowik, director of land brokerage at Chicago-based Cushman & Wakefield PLC, who isn’t involved with these Apopka projects or deals.

The market is expected to continue to see developers vying for land as more people move there and as SR 429 construction work is completed in 2023, Slowik said. “There are a lot of eyes on Apopka.”

Beyond that, the Apopka/Silver Star industrial market features a 15.2% average vacancy rate, well above the Orlando-area’s overall average of 8.2% — likely due to all the new product being built but not yet leased. The submarket’s average asking monthly rent for warehouse/distribution space is $7.15 per square foot, higher than the Orlando-area average of $5.97 per square foot. The higher prices in the Apopka submarket may demonstrate that users are willing to pay more for this space.